| Pair | Spot | 1w | 1m | 3m | 6m | 9m | 1y | ||

|---|---|---|---|---|---|---|---|---|---|

| EURUSD | 1.1739 (0.28%) | 5.41 (+0.31) | 5.29 (+0.29) | 5.63 (+0.18) | 6.08 (+0.18) | 6.43 (+0.18) | 6.67 (+0.17) | ||

| USDJPY | 158.20 (-0.27%) | 8.98 (+0.06) | 8.95 (+0.19) | 9.05 (+0.02) | 9.25 (0) | 9.4 (+0.01) | 9.44 (-0.02) | ||

| GBPUSD | 1.3523 (0.72%) | 5.4 (+0.2) | 5.6 (+0.15) | 6.2 (+0.1) | 6.85 (+0.1) | 7.3 (+0.05) | 7.6 (+0.1) | ||

| AUDUSD | 0.6852 (0.67%) | 8.04 (+0.36) | 7.63 (+0.18) | 8.04 (+0.13) | 8.56 (+0.11) | 8.93 (+0.07) | 9.2 (+0.09) | ||

| USDCAD | 1.3774 (-0.34%) | 4.58 (+0.1) | 4.27 (+0.01) | 4.61 (+0.11) | 4.98 (+0.08) | 5.25 (+0.05) | 5.48 (+0.02) | ||

| USDCHF | 0.7905 (-0.25%) | 6.75 (+0.25) | 6.6 (+0.25) | 6.95 (+0.2) | 7.3 (+0.2) | 7.6 (+0.2) | 7.74 (+0.19) | ||

| EURJPY | 185.70 (0.01%) | 7.85 (-0.12) | 8.08 (+0.21) | 8.11 (+0.07) | 8.42 (+0.04) | 8.66 (+0.05) | 8.79 (+0.03) | ||

| EURGBP | 0.8680 (-0.44%) | 3.55 (+0.2) | 3.75 (+0.1) | 4.15 (+0.1) | 4.65 (+0.05) | 5 (+0.05) | 5.15 (0) | ||

| EURCHF | 0.9279 (0.02%) | 3.8 (0) | 3.65 (-0.05) | 4 (-0.05) | 4.45 (-0.05) | 4.77 (-0.03) | 4.95 (-0.1) | ||

| XAUUSD | 4933.65 (2.10%) | 26.93 (+1.21) | 24.05 (+1.1) | 22.79 (+0.72) | 21.89 (+0.49) | 21.34 (+0.34) | 20.76 (+0.18) | ||

| XAGUSD | 98.9075 (5.60%) | 66 (-1.46) | 64.8 (+0.64) | 62 (+1.33) | 53.3 (-1.76) | 52 (+1.06) | 48.5 (+0.85) |

| Pair | Spot | 1w | 1m | 3m | 6m | 9m | 1y | ||

|---|---|---|---|---|---|---|---|---|---|

| EURUSD | 1.1739 (0.28%) | 0.45 (+0.29) | 0.52 (+0.24) | 0.55 (+0.19) | 0.58 (+0.15) | 0.6 (+0.12) | 0.63 (+0.11) | ||

| USDJPY | 158.20 (-0.27%) | -2.01 (-1.19) | -1.18 (-0.43) | -0.8 (-0.14) | -0.58 (-0.05) | -0.46 (-0.02) | -0.39 (-0.01) | ||

| GBPUSD | 1.3523 (0.72%) | -0.1 (+0.02) | -0.2 (-0.01) | -0.3 (+0.01) | -0.45 (-0) | -0.55 (0) | -0.61 (+0.03) | ||

| AUDUSD | 0.6852 (0.67%) | -0.01 (+0.37) | -0.26 (+0.26) | -0.5 (+0.16) | -0.67 (+0.12) | -0.77 (+0.1) | -0.88 (+0.07) | ||

| USDCAD | 1.3774 (-0.34%) | -0.13 (-0.07) | -0.06 (-0.06) | -0.03 (-0.05) | -0.02 (-0.04) | -0.02 (-0.03) | -0.03 (-0.03) | ||

| USDCHF | 0.7905 (-0.25%) | -1 (-0.28) | -0.99 (-0.16) | -1.03 (-0.11) | -1.06 (-0.1) | -1.08 (-0.09) | -1.08 (+0.01) | ||

| EURJPY | 185.70 (0.01%) | -1.42 (-0.82) | -0.9 (-0.25) | -0.71 (-0.05) | -0.65 (+0.01) | -0.63 (+0.04) | -0.63 (+0.05) | ||

| EURGBP | 0.8680 (-0.44%) | 0.37 (0) | 0.45 (+0.04) | 0.58 (+0.05) | 0.73 (+0.04) | 0.81 (+0.04) | 0.88 (+0.04) | ||

| EURCHF | 0.9279 (0.02%) | -0.56 (-0.02) | -0.56 (-0.01) | -0.62 (-0.01) | -0.69 (-0.01) | -0.74 (-0.01) | -0.77 (0) | ||

| XAUUSD | 4933.65 (2.10%) | 1.97 (+0.36) | 2.47 (+0.15) | 2.75 (+0.03) | 2.65 (-0.01) | 2.51 (-0.01) | 2.36 (-0.03) | ||

| XAGUSD | 98.9075 (5.60%) | 6.4 (0) | 10.7 (+0.26) | 12.76 (0) | 12.57 (0) | 11.97 (0) | 11.39 (0) |

| Friday 23-Jan-2026 | Monday 26-Jan-2026 | Tuesday 27-Jan-2026 | Wednesday 28-Jan-2026 | Thursday 29-Jan-2026 |

||

|---|---|---|---|---|---|---|

EURCHF 0.9225 USDCAD 1.3640 1.3625 1.3620 | EURUSD 1.1630 USDCAD 1.4175 1.4170 1.4165 |

|

EURUSD CHARTS

|

|

|

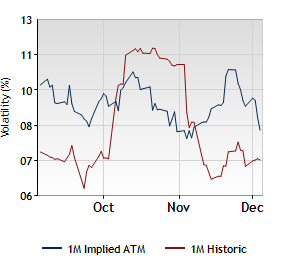

Implied vs. Historic Volatility

|

Risk Reversal vs. Spot

|

|

|

|

USDJPY CHARTS

|

|

|

Implied vs. Historic Volatility

|

Risk Reversal vs. Spot

|

|

|

|

GBPUSD CHARTS

|

|

|

Implied vs. Historic Volatility

|

Risk Reversal vs. Spot

|

|

|